What is happening?

New standards and regulations, headlined by the Corporate Sustainability Reporting Directive (CSRD) in the EU, the SEC Climate Disclosure Rule in the US, and California’s Climate Corporate Data Accountability Act are compelling organizations to put in place sustainability reporting environments. In an economic climate where earnings are already under pressure, funding the regulatory requirement is crowding out funding for the sustainability program itself. In fact, the 2023 EY Global DNA of the CFO Survey revealed that although surveyed CFOs see sustainability as a top priority, 37% had already cut sustainability funding to hit short-term earnings targets.

That presents a challenge.

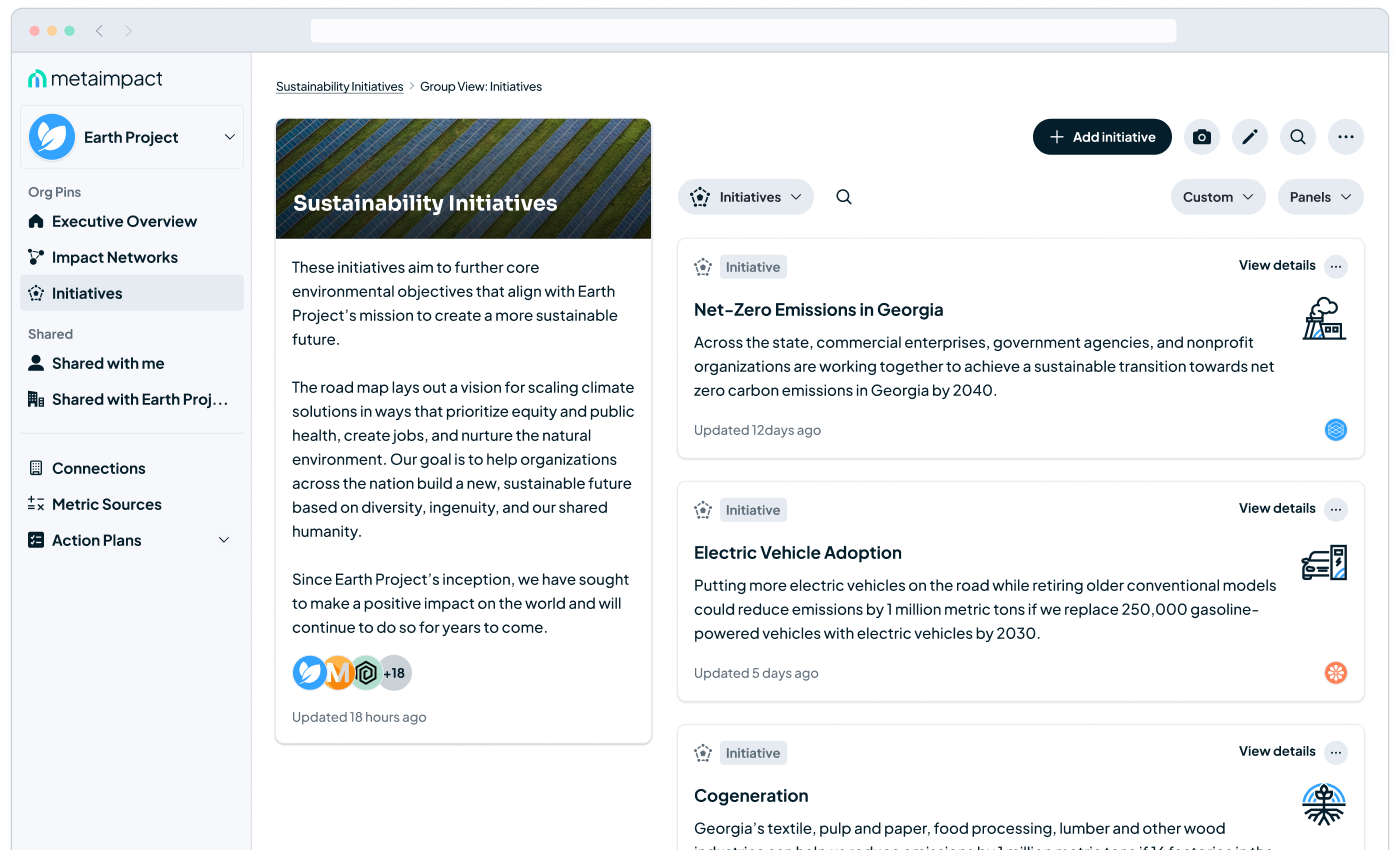

A lack of funding for the core sustainability programs that are there to drive performance may, ironically, create reputational risk once reporting results are made public and open to scrutiny and comparison. At a minimum, programs need a management and measurement environment – now – to address the interdependencies and complexities of multi-stakeholder, multi-discipline initiatives that span internal functions and external organizations. These systems are critical to gain initial traction, onboard newly formed matrixed teams, learn from and overcome unfamiliar hurdles, and be able to identify those initiatives that can produce sustainability and financial gains.

Why does it matter?

Sustainability is not typically core to an organization’s business: it is not their core revenue stream, core competency, or core strategic priority. It is driven by external factors – the impacts of climate change, regulatory requirements, increasing customer and stakeholder sentiment, and valuation considerations. This means that most organizations don’t have the skills, practices, systems, or processes in place to efficiently take on sustainability. Sustainability programs are on a learning curve and need the time and space to build, learn, adapt, and perform.

The larger point may be the unintentional outcome of creating avoidable risk. Deferring investments will create the ironic outcome where the regulations that create public disclosure and comparability may also show that organizations are not making sufficient progress on their sustainability programs – at a time where downstream customers and consumers are increasingly engaged and will increasingly be making buying decisions based on sustainability performance.

What does it mean to organizations going forward?

Preparing for regulations coming into place starting in 2024 is critical. But the intent and outcome of those regulations is to encourage progress through vetted transparency – meaning enabling public scrutiny and comparability. As we look to 2024 and 2025, a lack of progress will increasingly translate to reputational and financial risk whether that pressure is coming through customers demanding Scope 3 (emissions in the upstream and downstream value chain) progress or consumers moving spend to those they believe are making progress.

Today’s economic climate may not allow for significant investment in the program itself, but organizations greatly benefit from a methodical investment plan that puts the sustainability program in motion and gets in front of foreseeable risk in 2025.

Key to that early investment is a management and measurement environment that gives you the control and confidence that the investments will translate to real gains. Importantly, these systems greatly increase the likelihood that your sustainability program can identify and execute those initiatives that are able to produce both financial and sustainability gains. Without a management and measurement environment in place, organizations are likely to address sustainability in an ad hoc, unorchestrated manner with most of the use of resources under the radar, hidden in operational budgets.

Navigating today’s economic uncertainty and meeting pending sustainability regulations are likely to take a front seat in terms of budgeting, but methodical investment in sustainability programs that is mindful of both affordability and the foreseeable financial risk is likely the best path to meet short-term and long-term financial goals.

Request a demo today to learn how Metaimpact is helping companies deliver on their sustainability programs and play their role in creating a more sustainable world.