Monitoring the Metrics that Matter

Quantifying the impact of strategic initiatives is a critical aspect of success in today's digital age. It’s a task that is becoming increasingly complex, yet more vital than ever before.

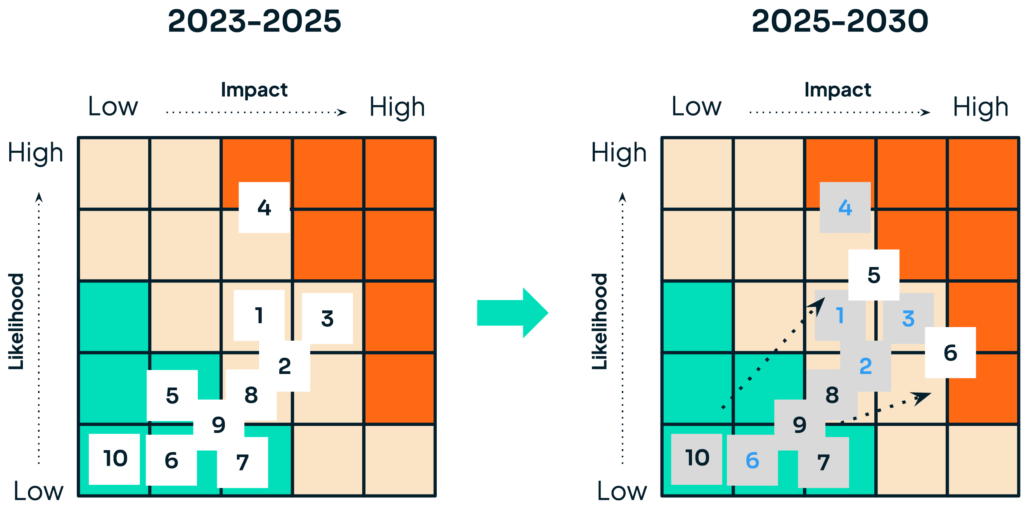

New standards and regulations, headlined by the Corporate Sustainability Reporting Directive (CSRD) in the EU, the SEC Climate Disclosure Rule in the US, and the California’s Climate Corporate Data Accountability Act are coming into place in 2024 and 2025 that will change the fundamentals of sustainability. Regulations that will expand accountabilities, while driving public scrutiny and comparability. On top of that, market pressures will increase from stakeholders, customers, and competitors. The combined effect is that there will be a notable increase in risks from the 2023-2025 to the 2025-2030 timeframe.

Today, sustainability risks are relatively muted and, given the priority to deliver financial performance, companies are focusing their limited sustainability resources on building the necessary reporting. In fact, the recent DNA of the CFO Report revealed that although surveyed CFOs see sustainability as a top priority, 37% had already cut sustainability funding.

But by doing so, they may be crowding out funding for the sustainability program itself as they face a far different risk environment starting in 2025.

Regulatory requirements and market pressures will create a vastly different and more challenging risk environment as we look to 2025:

For most organizations, sustainability is new and different from core revenue management and operations. With no blueprint guiding efficient progress, there is little sense that organizations have the agility to rapidly sense and mitigate risks – organizations need time.

So deferred investment or action today likely translates to taking on significant risks in 2025 – risks that organizations may not be able to quickly or easily address.

On one hand, it makes sense that companies may be cautious about funding sustainability to avoid impacting financial performance – and using their limited funds to address the coming regulatory requirements.

But there needs to be a balance, as over-cautious investment today can translate to untenable risks tomorrow. It is far easier to prudently invest in sustainability in a more methodical manner, paying close attention to affordability and the ability to deliver results than to hold back only to overspend later to try to address growing reputational, customer, and financial risks.

So how does a sustainability program balance today’s financial pressures with 2025’s risks?

We recommend a prudent investment plan that finds the best balance between financial and sustainability performance, and a sustainability program that prioritizes those initiatives that can best deliver to that balance. For example, leaders may prioritize initiatives that produce financial results, even if they provide relatively less sustainability results. This builds both working and political capital and drives progress that reduces the escalating risk profile expected in 2025. In addition, the program may focus on a balanced portfolio of initiatives: some that have low expected cost and execution with a select few with higher cost and risk to test and build the programs’ capabilities.

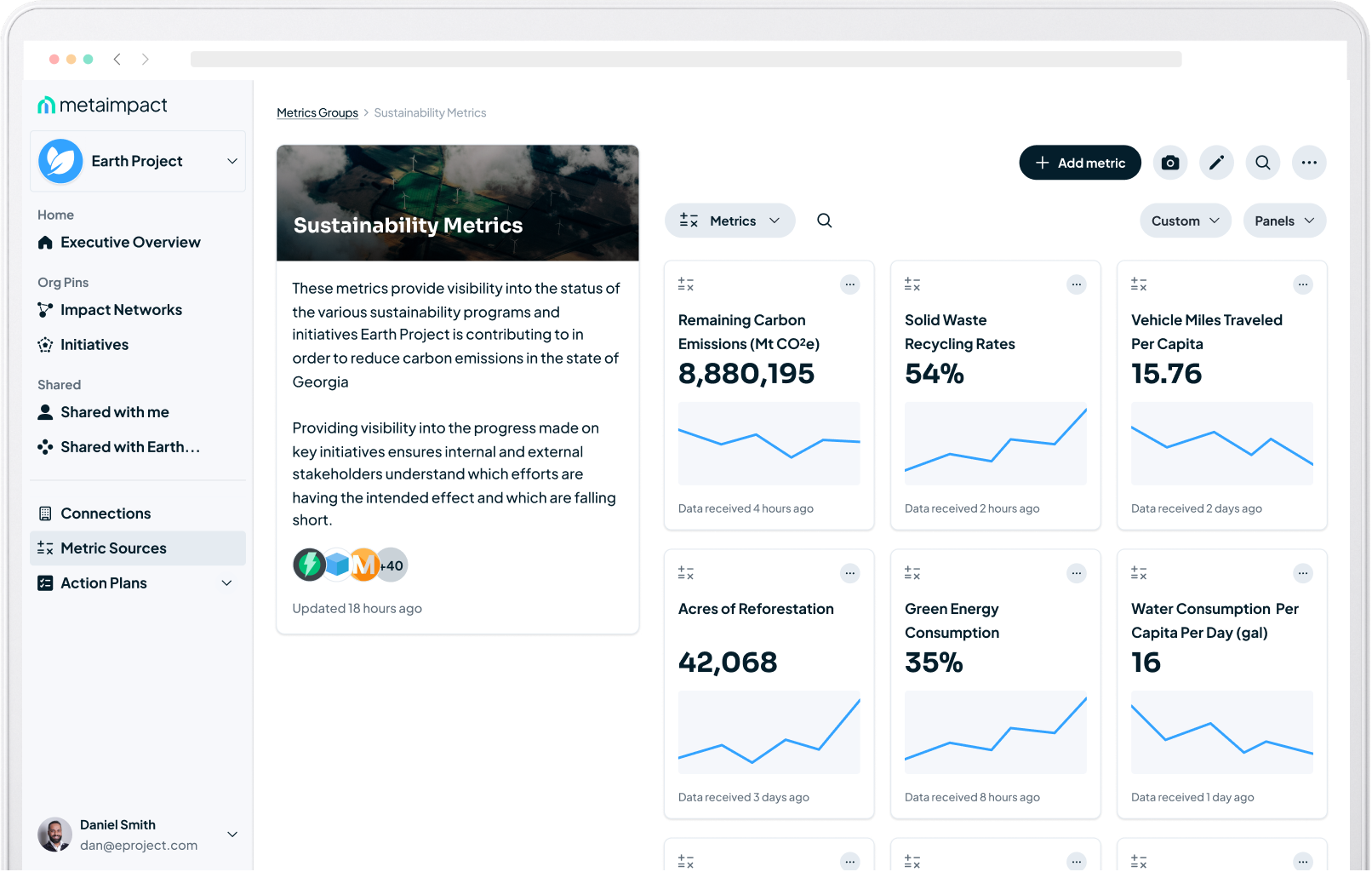

Sustainability programs will need a robust program management and measurement environment able to provide the visibility, analytics, and context to make the best decision and maximize results. That is where Metaimpact can help.

A prudent investment strategy today—a strategy that balances financial and sustainability performance—is the best way to efficiently stay in front of escalating risks and have a plan that allows you to control your own destiny.

Learn how Metaimpact empowers organizations with the digital infrastructure needed to enable systems change.

Download the ebook to learn how your organization can go beyond reporting and put a sustainability program in place that drives real progress.

Download the one pager to learn how Metaimpact enables organizations to build digital impact networks to confront the world’s biggest problems.

Learn how Metaimpact empowers organizations with the digital infrastructure needed to enable systems change.

Quantifying the impact of strategic initiatives is a critical aspect of success in today's digital age. It’s a task that is becoming increasingly complex, yet more vital than ever before.

In order to use data more effectively, a different approach is needed—software that enables data storytelling.

Much of the world associates the metaverse with avatars and immersive VR experiences, which is key for consumers and some business applications, but this new computing paradigm offers a more foundational and transformative opportunity for the business world.

As data storytelling becomes a more integral part of business strategy, new opportunities will surface, valuable internal conversations will occur, and departments will become more aligned.

Request a demo to learn how Metaimpact helps organizations measure performance.